January 13th, 2013

…

…

Dangerous Challenges Face Manitoba Landlords in 2013 Making Equifax Tenant Screening Using Credit Checks More Important Than Ever

A year of challenges. That’s what Manitoba landlords face in 2013.

Looking back at what happened in the rental market and to landlords in 2012, the trends are clear.

And it’s not good news for good Manitoba landlords.

Whether you own your investment property in Winnipeg, Brandon, or elsewhere the message is clear: the current government is not on our side and are making it increasingly difficult for small landlords to succeed.

The trends make it more important than ever for Manitoba landlords to rent out to good tenants and avoid the pros.

Let’s look at some of these challenges and trends.

1. Want to raise the rent in 2013? The government set the rate at only 1%

We are all faced with lots of increased costs this year. Taxes are going up, utility costs are going up, and good contractors are charging more than ever to do repairs and improvements.

You want to maintain and even improve your rental property. That’s expensive.

So what does the government do? They say you can’t raise the rent more than 1%1

Why would anyone sane create such a short-sighted policy that will hurt good landlords who want to rent out great properties?

According to the government they, “…understand how stressful it can be for students, seniors and low-income families to make ends meet. Rent guidelines help ensure fairness for renters.”

Yeah, right.

Good properties require regular upkeep from good contractors. That means landlords have to pay and have to at least cover their costs. 1% doesn’t do that.

2. Bad Tenants Are Driving Out Good Tenants

Remember the story of the Chinese international student studying at the University of Manitoba? You know, the student who was lucky to dodge a bullet coming from another tenants.

The tenant was Kate Cheng was about to enjoy a late night snack when she realized drywall in the apartment was falling. She didn’t worry too much at the time because she thought a neighbour must have been doing some late night drilling to put up pictures.

It was only later she realized the seriousness of the situation – someone had shot bullets into her apartment and she was lucky to be alive.

3. Tenant Versus Tenant Violence is Escalating

Another example in 2012 shows trends for landlords.

Loud music and a floor-stomping tenant led to a woman being stabbed in an Agnes Street apartment Tuesday night, police said.

Or the tenant who stabbed his neighbouring tenant.

Police said the woman and two men were socializing in a suite while playing loud music around the supper hour.

A tenant directly above the group took offence to the noise and began jumping on the floor in an attempt to get the partiers to turn down the music. Two men from the party confronted the upstairs tenant, then returned to the downstairs suite, police said.

4. Government Social Housing Is Going Down the Drain (With Tenants Living in Fear)

Or lets discuss the tenant who is living in government housing who is scared beyond belief after another tenant was murdered in the same rental building

5. Tenants Complaining And Going Over Your Head and Directly to the Government

The current government is encouraging tenants to go over the landlords head with complaints.

Instead of mature discussion, tenants are being encouraged to contact government by-law officers to punish their landlords. This is common in other anti-landlord provinces.

So What Can A Landlord Do In The Current Anti-Good Landlord Environment We Face?

The key is renting to qualified tenants.

Qualified tenants will respect your property, respect the landlords, and pay on time!

How Can You Find Qualified Tenants?

The Manitoba Landlords Association has the answer.

The answer is making Equifax your partner in Tenant Screening and finding great, qualified tenants.

Equifax is the world-wide leader for credit fraud and screening.

MLA members can work with Equifax to make sure you you make objective and informed decisions when approving or declining prospective tenants.

MLA Members Have Access to:

- Online tool that captures information you already have such as applicant’s name, address and date of birth

- Takes the guesswork out of the credit worthiness decision

- Provides clear and concise recommendations—you do not need to be an expert on reading credit reports or interpreting credit scores

How it Works

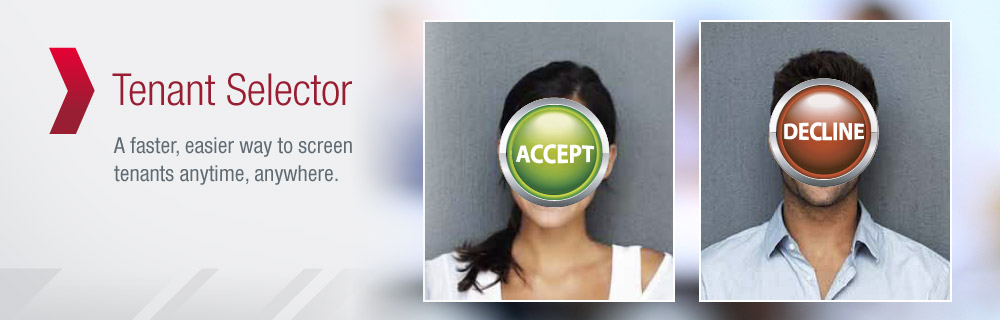

Whether you maintain two rental units or 200, we designed Tenant Selector with your needs in mind. It is easy to use, secure and provides a real-time recommendation based on the credit worthiness of the applicant(s). Tenant Selector considers:

The likelihood the tenant will declare bankruptcy in the next 24 months

- The probability the tenant will make their rent payments to you on time

- Irregularities or confirmed misuse in names, addresses and phone numbers—or other suspicious behaviour that could indicate fraud

- The tenant’s ability to afford the cost of rent plus other debts (Total Debt Service Ratio)

Even if your applicant does not have a credit score, Tenant Selector can still deliver an “accept” or “decline” recommendation based on all available information.

…